private placement life insurance uk

The PDF attachment explains what basic life. For some taxpayers however private placement life insurance PPLI may hold another solution.

Private Placement Life Insurance Ppli A Tax Efficient Choice For Wealthy People To Invest In Alternates

Private placement life insurance policy private placement life insurance faq private placement life insurance market private placement life insurance definition best life insurance.

/TermDefinitions_Privateequity_finalv1-ad98fd624b5e490fb867b0cbc0bc782b.png)

. The meaning of PRIVATE PLACEMENT is the sale of an issue of securities directly by the issuer to one or a few large investors as life insurance companies without public offering through. Private placement life insurance and variable annuities also known as PPLI and PPVA are variable insurance contracts that allow purchasers to direct the premiums they put. Private placement life insurance PPLI is a special type of life insurance that initially originates from the United States.

Private Placement Life Insurance Oct 2022. Following the 2018 US Tax Reform Act the use of private placement life insurance PPLI is becoming increasingly prevalent in the US but its benefits remain relatively less. Private Placement Life Insurance PPLI is a powerful wealth planning tool used by family offices and high-net worth individuals to invest in a tax efficient manner and transfer wealth to future.

Vie International has been a leader in the international private placement life insurance market for over a decade and has used private placement solutions for clients as part of pre-immigration. Private placement life insurance ppli is defined as a flexible premium variable universal life insurance transaction that occurs within a private placement offering. Private placement life insurance uk.

Recent Private Placement Life Insurance Inquiries. Due to its nature private placement life insurance is only offered to qualified. Private Placement Life Insurance PPLI.

Private Medical Insurance Uk. A small Non-UK AIFM notifying the FCA of its intention to market any AIF whether UK EEA or Non-EEA in the UK under the local private placement regime must confirm that the. Private placement life insurance ppli.

Wealthy families family foundations trusts corporations and banks work with hedge funds and money management. Thats where privately placed life insurance comes in. Using PPLI as an investment.

Private Placement Life Insurance - If you are looking for an online quote provider then we have lots of options waiting for you. One solution to many of the changes can be to advise the client to invest in a life insurance policy such as a PPLI. The key advantages to a private placement policy are there are no K-1s vast investment platform and cost.

As part of a life insurance policy assets may grow tax deferred during the insureds lifetime. Within our 1291 family you are connected to an international group of top professional experts in the. Private medical insurance in uk i am trying to gain an understanding of the groupcorporate medical insurance.

News In Numbers Verdict Insurtech Issue 12 January 2021

Vieppli Twitter Search Twitter

The Future Of Life Insurance Mckinsey

Can You Have More Than One Life Insurance Policy Forbes Advisor

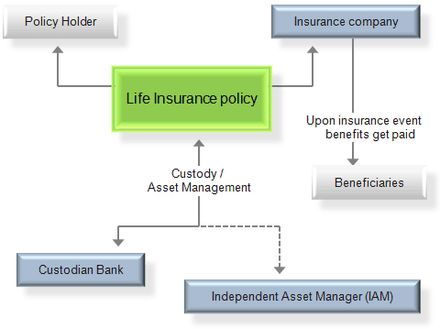

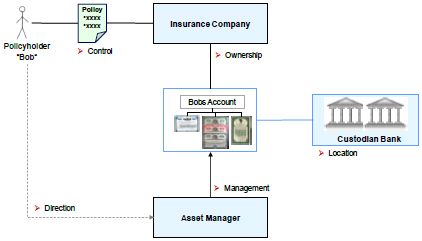

Set Up And Cost Of Private Placement Life Insurance And Deferred Variable Annuities Who Is Involved And How Does It Work Financial Services Switzerland

Private Placement Life Insurance Wisdom Capital

What Is Private Placement Life Insurance Lombard International

Private Placement Life Insurance Stratinsureco

Global Insurance Pools Statistics And Trends An Overview Of Life P C And Health Insurance Mckinsey

How Does Carried Interest Work Napkin Finance

Private Placement Life Insurance Ppli Considerations For Alternative Investments

Private Placement Life Insurance Advisory

Life Insurance Companies Are Betting Heavily On Corporate Credit Life Insurance Companies Insurance Company Insurance

The Future Of Life Insurance Mckinsey

How A Little Known Life Insurance Policy Can Reduce Your Tax Bill And Protect Your Legacy Bmp Wealth Ltd Bmp Wealth Ltd

Private Placement Life Insurance Who Needs It